Down Payment Assistance Resources:

04/17/2024

04/10/2024

Hollywood City-owned home for sale to eligible first-time homebuyer!

2323 Cleveland Street, Hollywood, 33020

- $350,000 purchase price

- 2 bedroom / 1 bath

- 1-car garage

- 922 square foot single family home (No HOA fees)

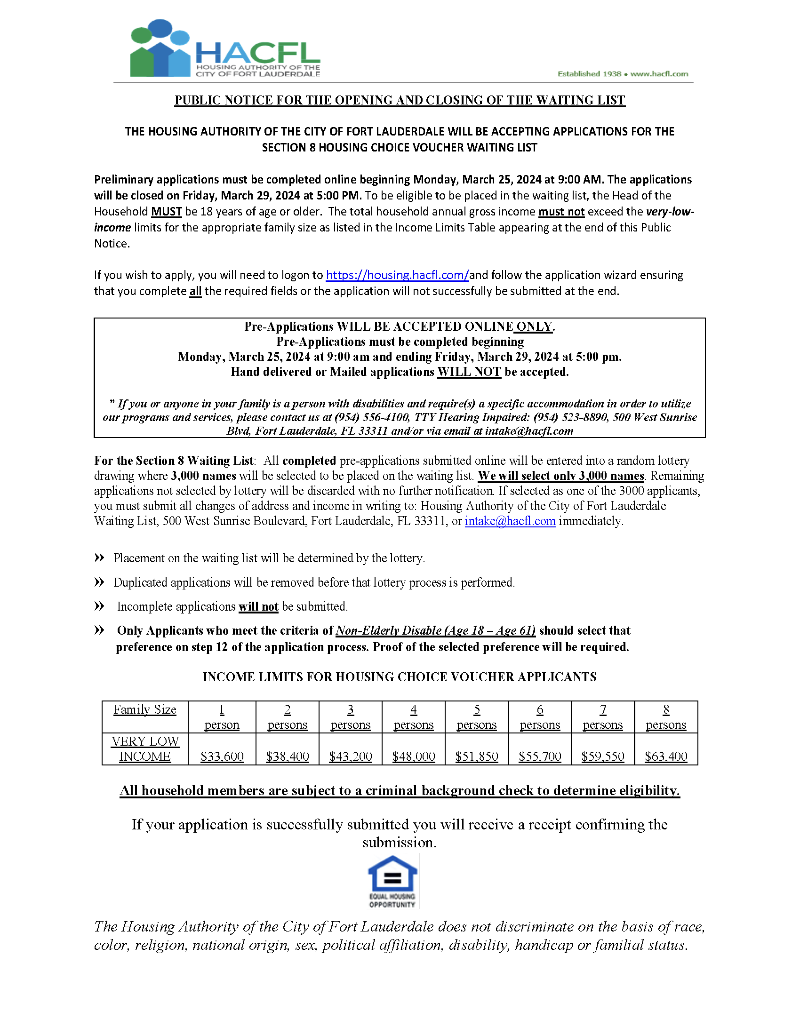

The City of Hollywood has a beautiful, fully renovated immaculate home for sale, along with up to $170,000 with a combination of SHIP and County/CRA/City (ILA) purchase assistance for the qualified, eligible homebuyer. Applicant submissions will be submitted as part of the Hollywood Home Buyer Purchase Assistance Program, which is administered by Broward County.

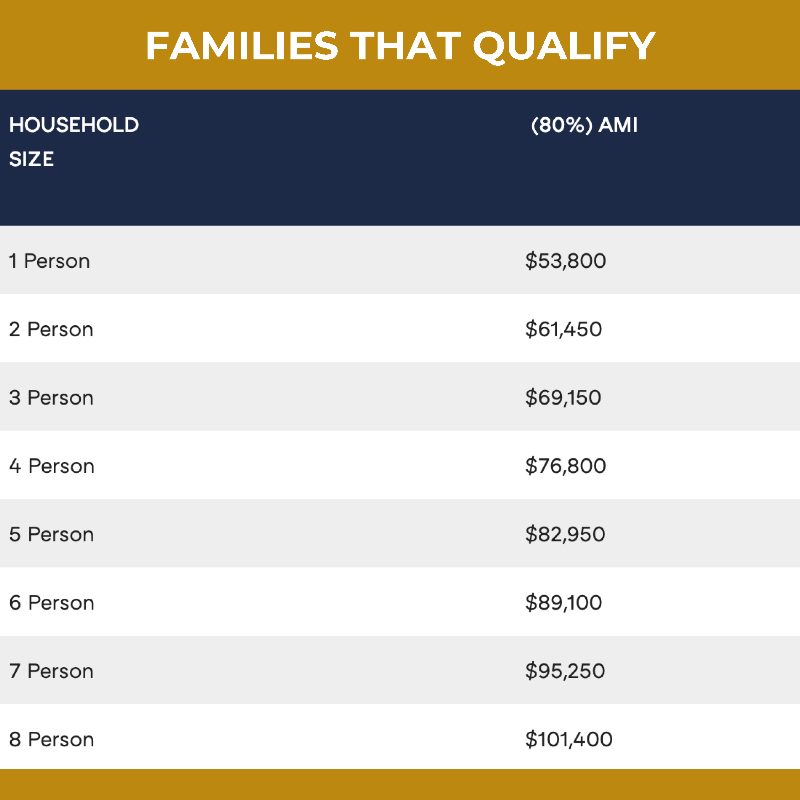

Priority will be given to current City of Hollywood residents with proof of residency (Government Issued ID, Utility Bill or Lease with a Hollywood address), and households at or below 80% AMI however all applicants will be accepted. LOIs will be reviewed for completeness on a first come, first qualified, first served basis.

| Household Size | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 80% Gross Annual Income (Priority Buyer) | $59,150 | $67,550 | $76,050 | $84,450 | $91,200 | $98,000 | $104,750 | $111,500 |

| 120% Gross Annual Income | $88,680 | $101,280 | $114,000 | $126,720 | $136,800 | $147,000 | $157,200 | $167,280 |

Letter of Intent (LOI) with signed mortgage preapprovals and all required documents must be submitted from April 10, 2024 at 9:00 am until 3:00 p.m. on Wednesday, May 1, 2024.

Please visit the City of Hollywood website https://www.hollywoodfl.org/1435/City-owned-Home-For-Sale for forms, required documents, lender guidelines, participating lenders, eligibility criteria, and step-by-step process.

03/20/2024

%202024%20(002).docx%20HOH%2055_thumb.png)

%202024%20(002).docx%20HOH%2062_Page_1_thumb.png)

03/08/2024

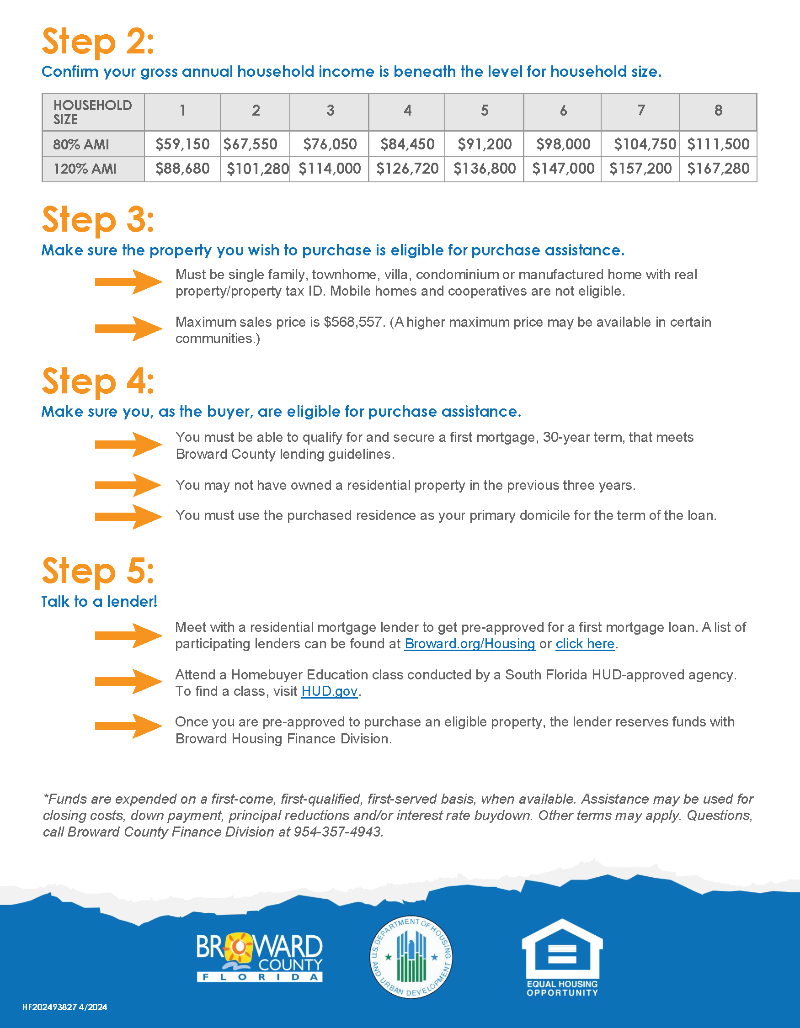

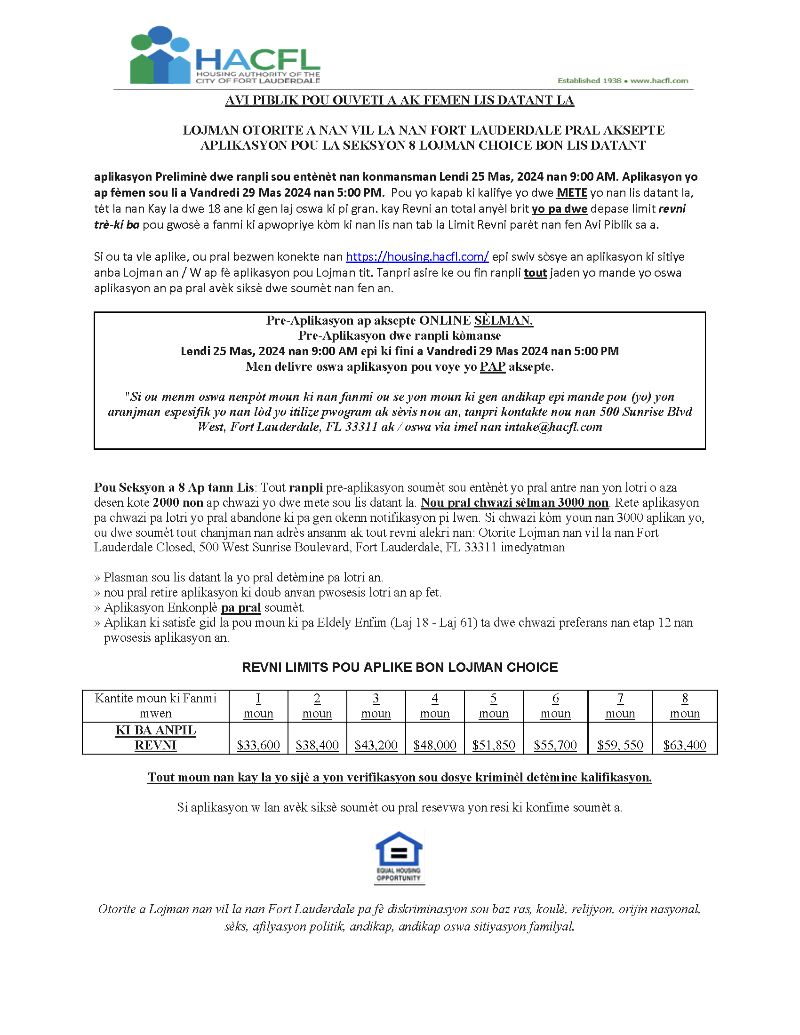

The Housing Authority of the City of Fort Lauderdale will be opening its Section 8 Housing Choice Voucher Wait List on Monday, March 25, 2024, at 9:00 am and will be closing on Friday March 29, 2024 at 5:00 p.m. They are accepting 3,000 randomly selected names to the waiting list via a lottery system. The applications will be taken online only at https://housing.hacfl.com/. Attached you will find the Spanish, Creole and English versions of the public notice.

02/06/2024

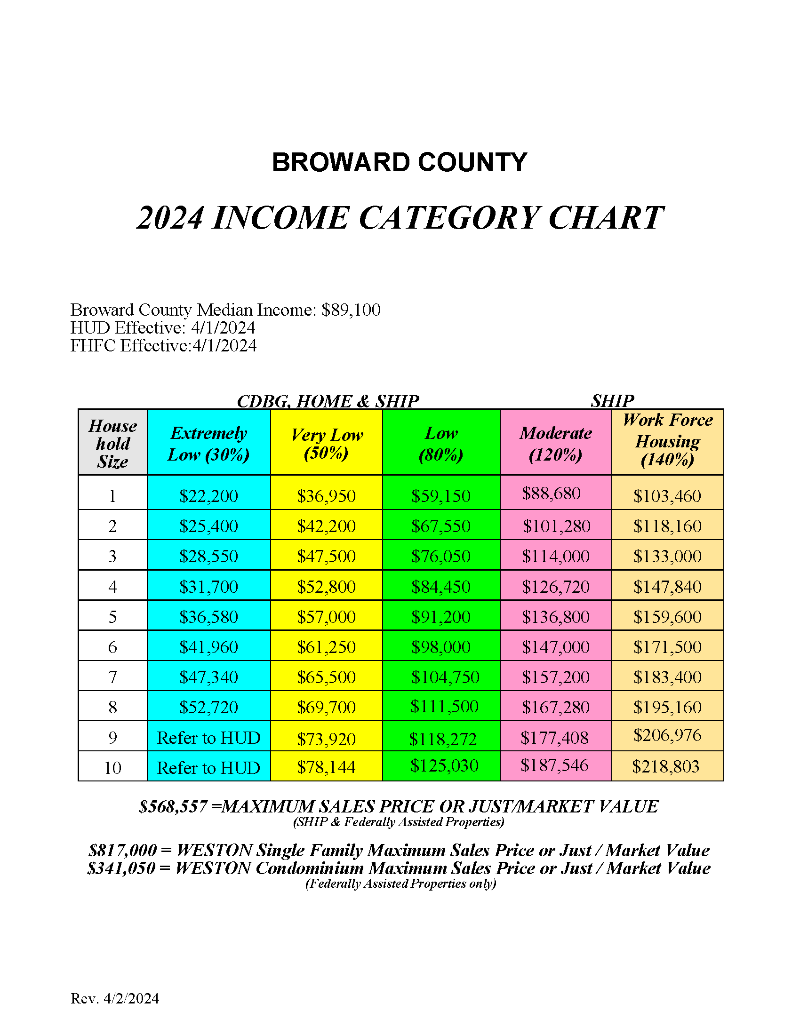

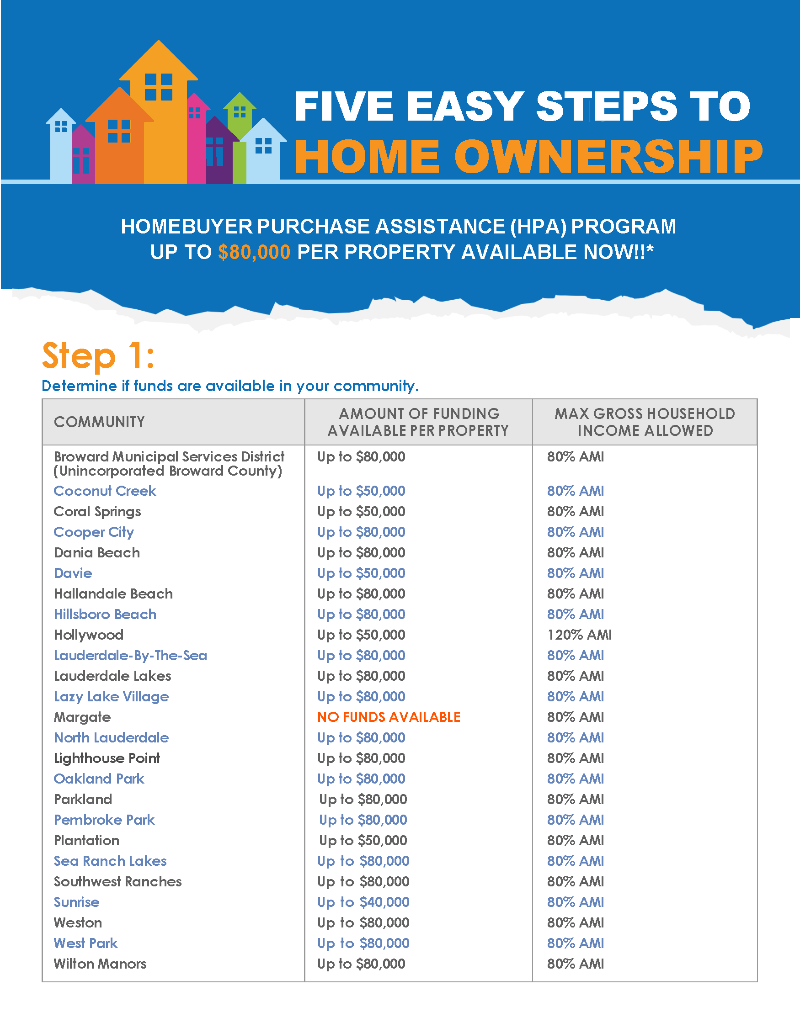

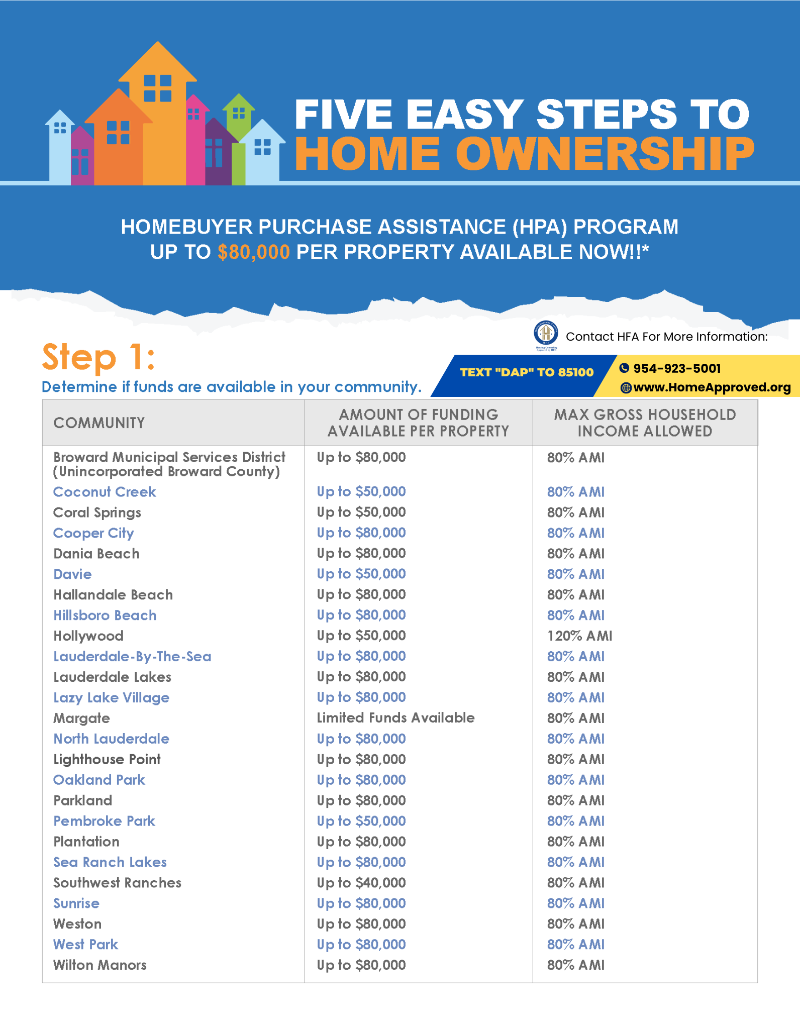

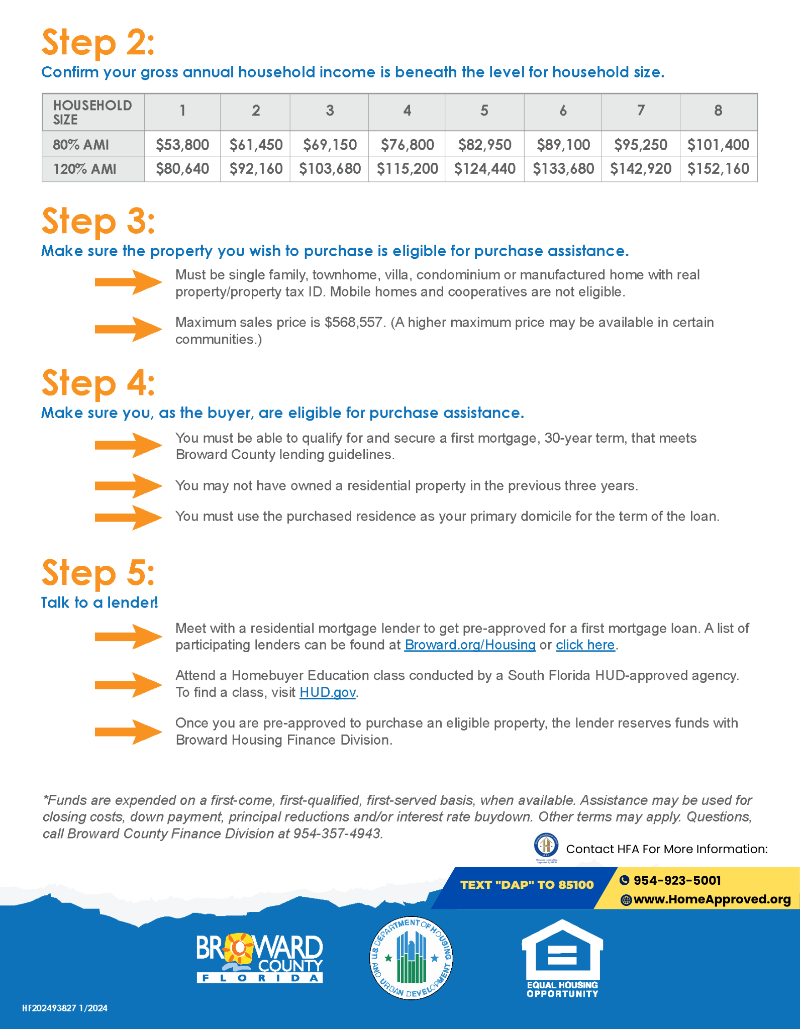

Broward County’s Homebuyer Purchase Assistance (HPA) program: The most current flyer, and the list below reflects all Broward cities we serve that currently have HPA funds.

HPA program details:

Eligible buyers must qualify for a first mortgage loan (conventional, FHA, or VA) that meets County guidelines. Eligible buyers gross household income must be within the limits for that area; buyer may not have owned a residential property in the previous 3 years; and buyers are to attend a Homebuyer Education (HBE) class provided by a local HUD approved housing agency. CLICK HERE to register for an upcoming HFA Home Buyer Education class!

As always, funds are available on a first-come, first-qualified, first-served basis, until funds are fully expended.

02/032024

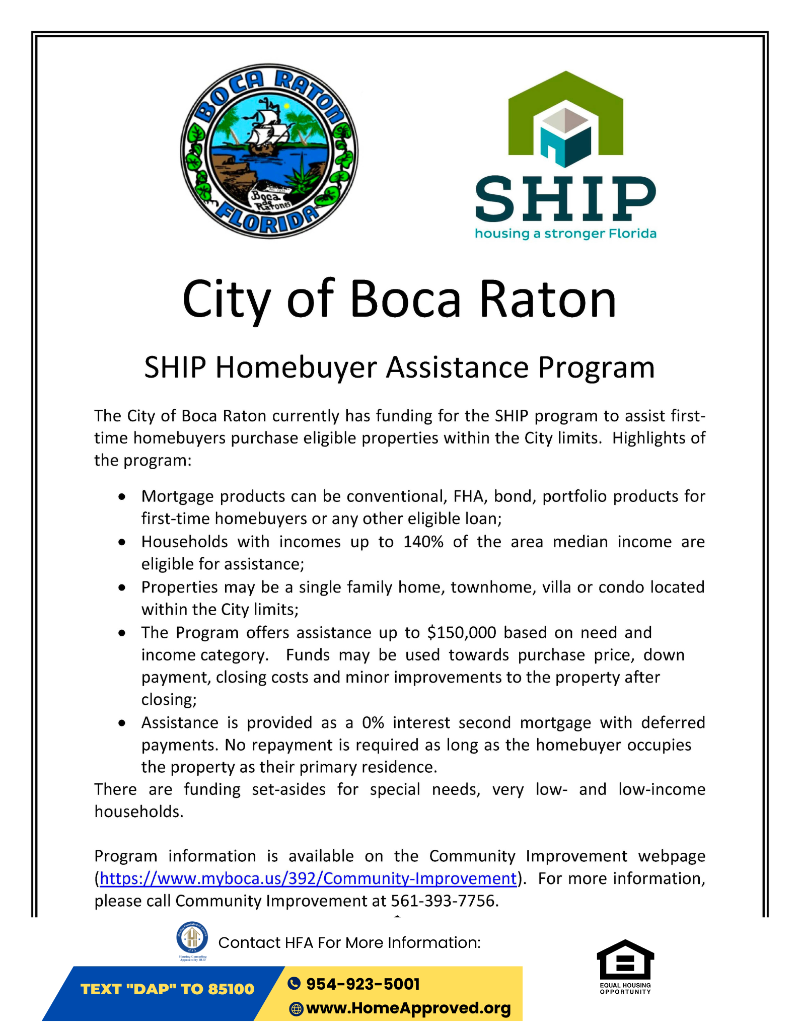

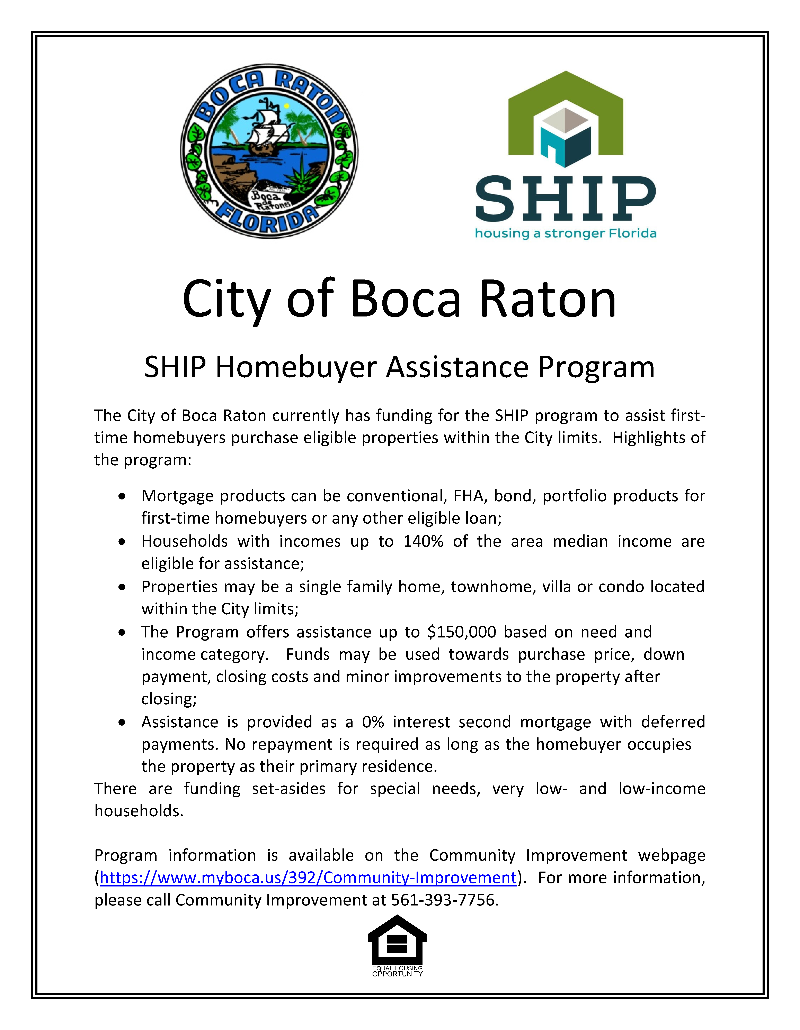

City of Boca Raton Homebuyer Assistance program information - which includes the increase to the maximum award amounts.

Information for all available programs through the City is available at SHIP Purchase Assistance Programs | Boca Raton, FL (myboca.us).

01/30/2024

CLICK HERE to Complete the Palm Beach County Homeownership Application

01/29/2024

_thumb.jpg)

01/17/2024

01/03/2024

The 2024 Davis Landings Wait List Opens on Thursday, January 11, 2024 at 10:00 am

If you are interested in Davis Landings at 4938 Davis Rd, Lake Worth FL. Vacancies at the property of 1, 2 and 3 bedroom units is filled exclusively through the Community Land Trust of Palm Beach County Wait List.

To be placed on the 2024 Waiting List for a particular unit size and rent rate; please follow the link below on the website to complete the Wait List Application, when it becomes live, starting at 10:00 am on Thursday, January 11, 2024.

https://cltofpbc.org/live-with-us/davis-landings/

The Waiting List is kept until December 31 of each year and then purged. The Waiting List is re-opened the second Thursday in January each year.

| Apartments | Unit Size | Rent per month |

| 1x1 | 700 sq. ft. | $310.00 - $908.00 |

| 2x2 | 1,000 sq. ft. | $404.00 - $1,155.00 |

| 3x2 | 1,400 sq. ft. | $872.00-$1,365.00 |

The office is at Davis Landings and is open virtually and with limited in person service Monday – Friday 9:00-5:00.

Other Important Davis Landings Apartment Information:

If a tenant does not renew their lease or if a tenant’s lease is terminated by us, we pull from the Waiting List applications based on unit size, income category and the date the Waiting List Application was submitted.

If your application is pulled from the Waiting List you will need to submit a completed application and the relevant documents from the Checklist.

Additional Davis Landings Rental Information is:

· The Security Deposit is one month's rent. Then applicants pay the 1st month's rent at the time of move-in.

· Utilities are not included in the rent. Electricity service is provided by Lake Worth Beach Utilities and the water by PBC Water. The property is wired for Comcast.

· One pet is allowed and it must be less than 25lbs.

· The application fee is $30.00 per adult. It involves a background check and credit check. The background/credit check process takes about 7-10 days. No felonies involving crimes against another person or another person's property are allowed.

12/21/2023

Are you, or do you know of, anyone currently facing evictions; or is homeless in Palm Beach County?

Let's Break the Cycle of Homelessness! Click the links below to learn more about Palm Beach County's Homelessness Prevention Resources:

https://discover.pbcgov.org/communityservices/pages/public-notices.aspx

www.TheHomelessPlan.org/

11/29/2023

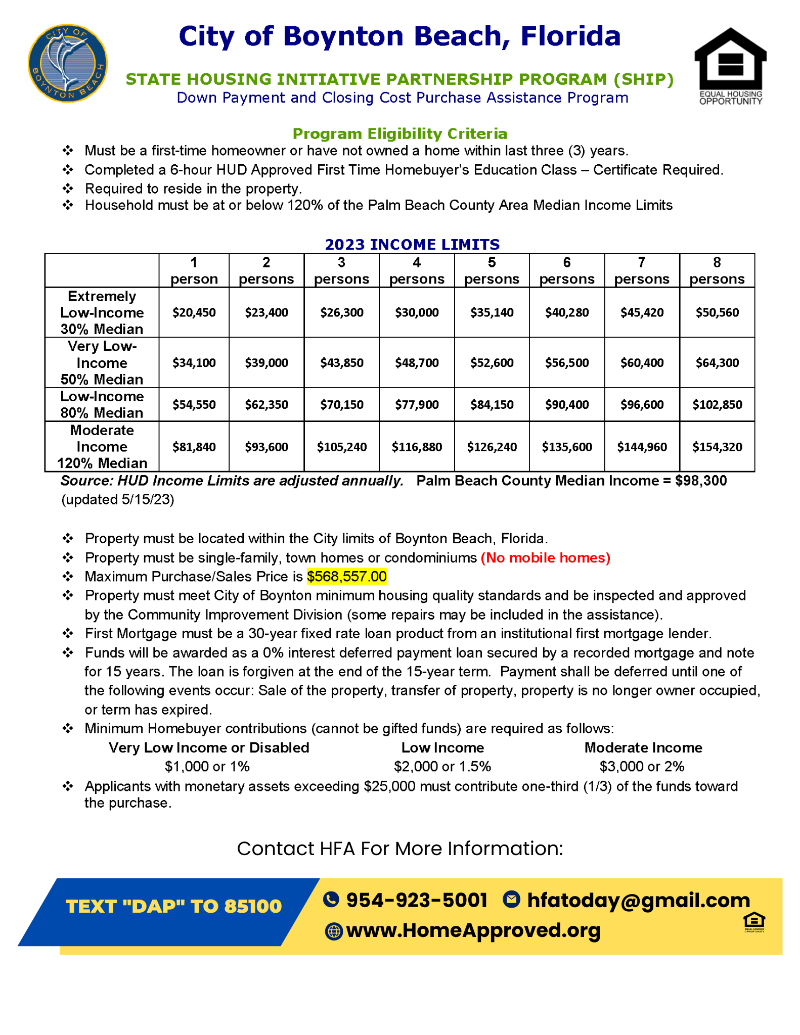

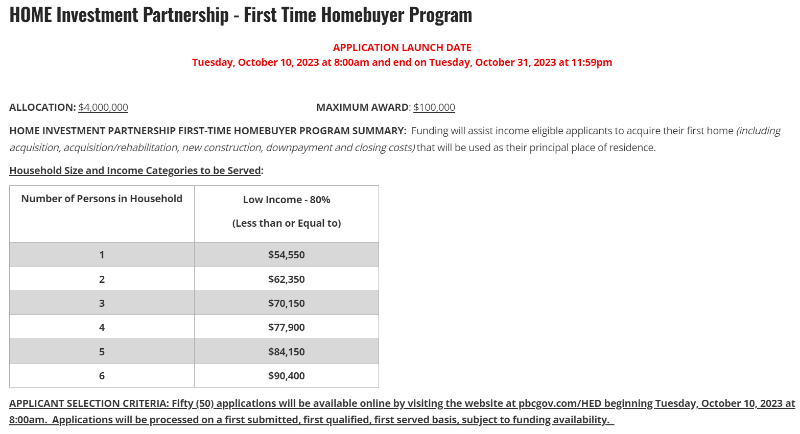

Palm Beach County SHIP - Purchase Assistance Program

Palm Beach County Department of Housing and Economic Development hereby announces the availability of up to $3,000,000 under the State Housing Initiatives Partnership (SHIP) Purchase Assistance Program. Funding will provide up to $100,000 to assist income eligible applicants/households to acquire their first home (including acquisition, acquisition/rehabilitation, new construction, downpayment and closing costs) that will be used as their principal place of residence.

Click the image below to for more information:

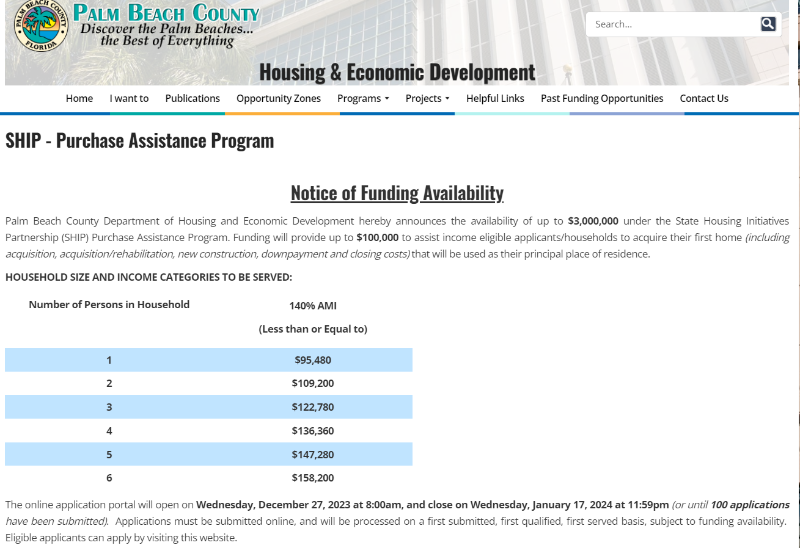

11/15/2023

11/15/2023

Maximum Purchase Price Fort Lauderdale: $372,000

All applicant must live within the city limits of the City of Fort Lauderdale

Contact:954-828-6024

Email: dgraham@fortlauderdale.gov

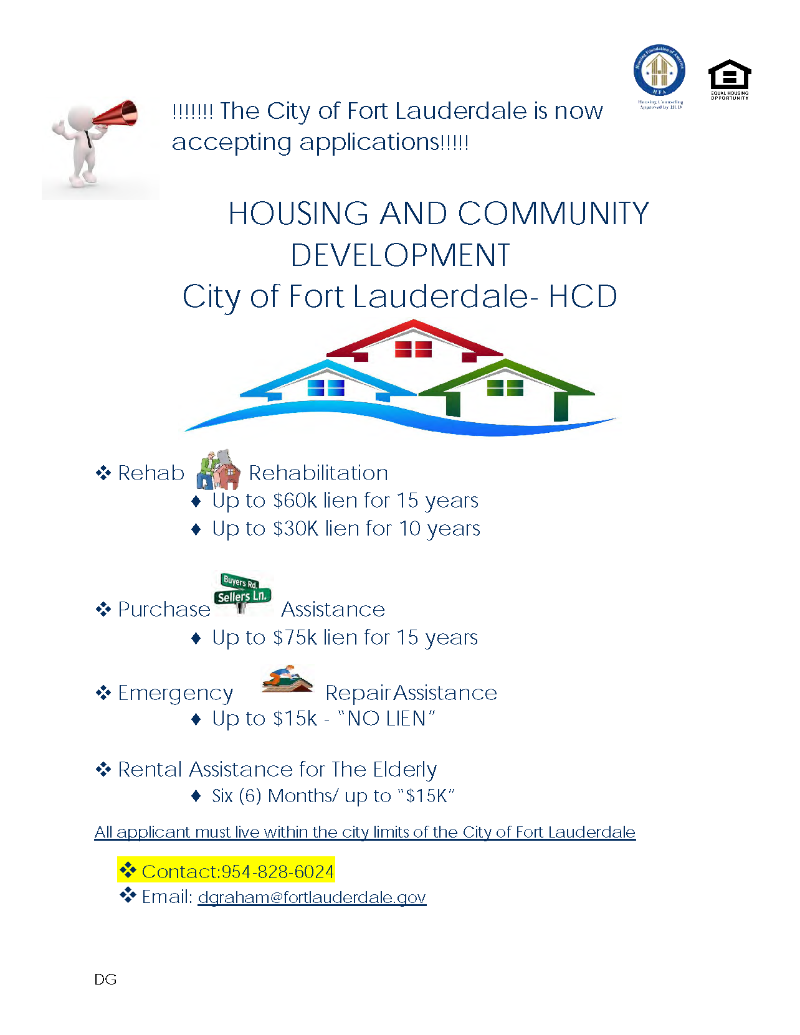

09/15/2023

Palm Beach County to provide up to $100,000 to eligible first-time homebuyers! Online application portal will open Tuesday, October 10, 2023 at 8:00am. Applications will be processed on a first-submitted, first-qualified, first-served basis, subject to funding availability.

CLICK HERE OR IMAGE BELOW FOR MORE APPLICATION INFORMATION

08/24/2023

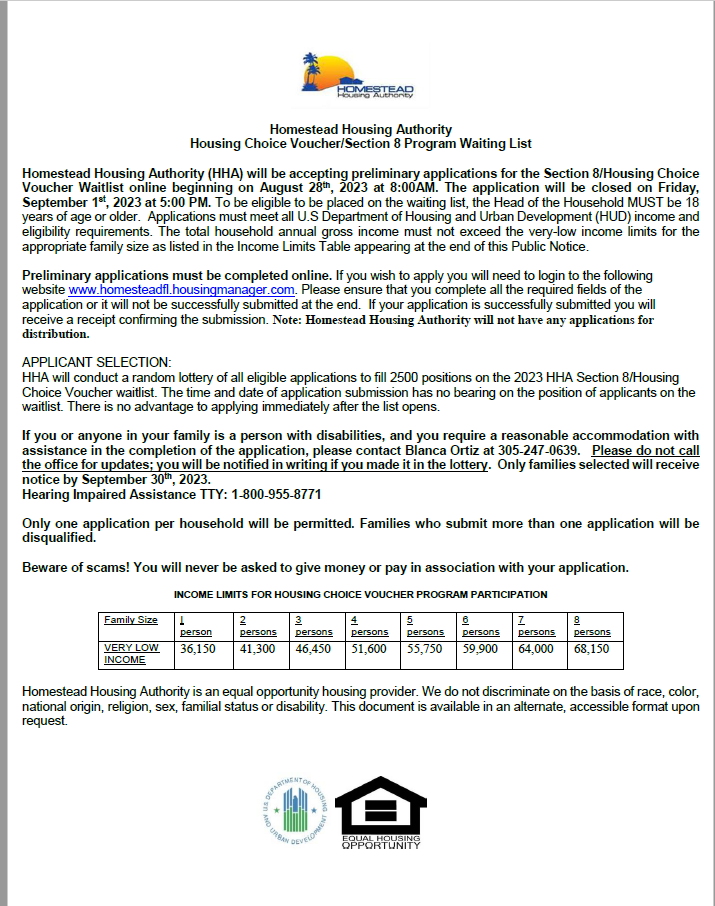

Homestead Housing Authority will be opening it’s Section 8 Waiting List on Monday August 28, 2023 at 8:00 am and closing on Friday September 1st, 2023 at 5:00 pm. Applications will be online only at www.homesteadfl.housingmanager.com

08/17/2023

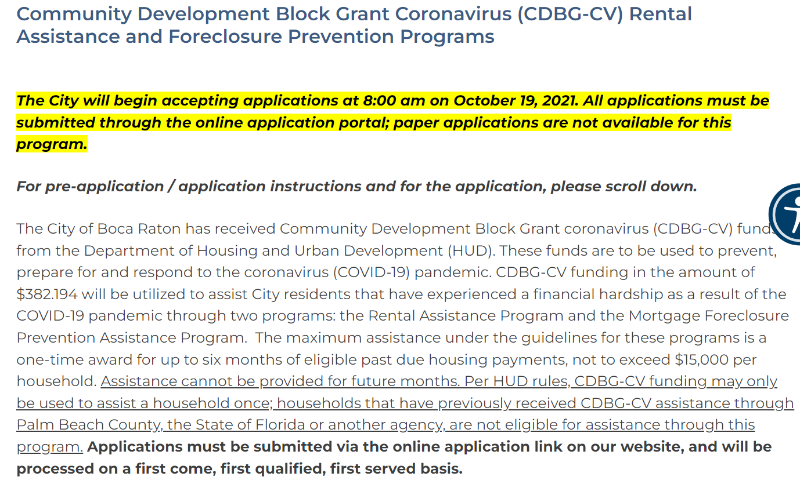

The City of Boca Raton is still accepting applications for CDBG-CV Emergency Housing Assistance Program! This program may provide up to six months of past due rent or mortgage payments to eligible Boca Raton residents. Program information, required documents, and the application can be found online at: Rental and Foreclosure Programs | Boca Raton, FL (myboca.us)

08/15/2023

City of Boca Raton First Time Home Buyer Assistance flyer - Including Maximum Award Amount Increase

Information for all available programs through the City is available at https://www.myboca.us/396/Financial-Assistance-Programs.

08/10/2023

City of Durham Relauches Down Payment Assistance (DPA) Program

"Durham residents who are in the market to buy their first home will soon be able to apply for up to $80,000 for down payment and closing costs assistance from a relaunched City of Durham Down Payment Assistance (DPA) Program. The DPA Program is funded and administered through the City of Durham, Community Development Department." - Phyllis Coley August 5, 2023

CLICK HERE FOR MORE INFORMATION

08/10/2023

08/10/2023

06/16/2023

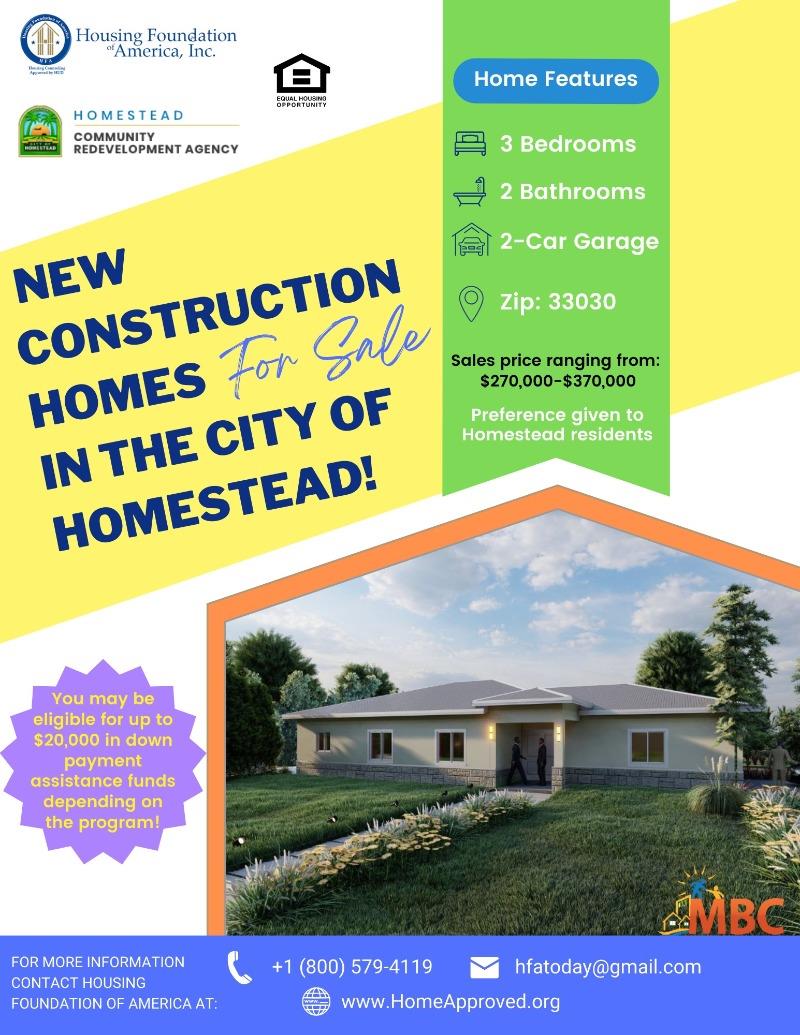

Meet the Home Buyer Education requirement and register now for a HUD-Certified Home Buyer Workshop with HFA! www.HomeApproved.org/Upcoming-Events

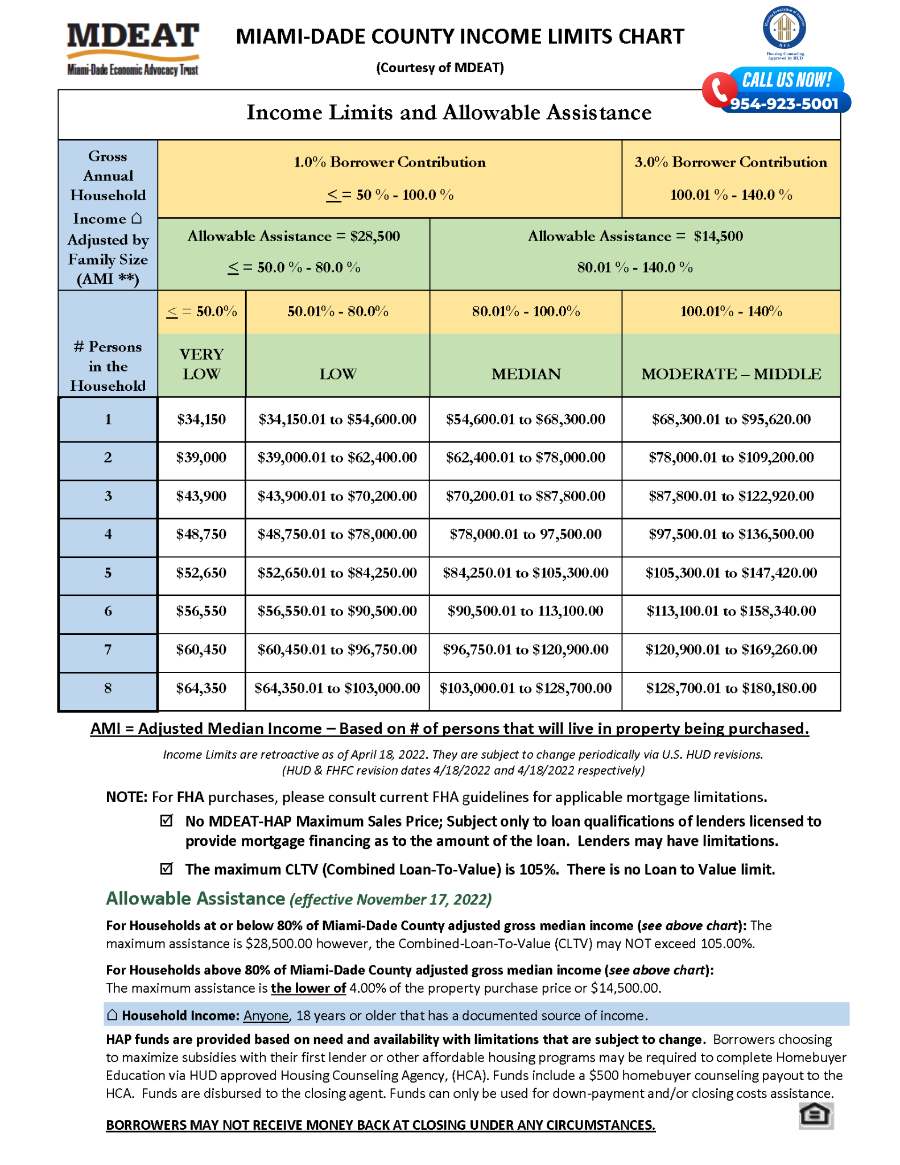

For more information on the Miami-Dade Economic Advocacy Trust (MDEAT) Homeownership Assistance Program (HAP) please visit www.HomeApproved.org/Miami-Dade-County-Resources

_thumb.png)

05/09/2023

The City of Greensboro’s Down Payment Assistance Program (Housing Connect) has updated program requirements! CLICK HERE to apply!

Earn your Home Buyer Education requirement and REGISTER HERE for HFA's upcoming North Carolina HUD Certified Home Buyer Workshop!

_thumb.png)

05/03/2023

04/14/2023

04/10/2023

Deadline tomorrow April 11th @ 3PM for City-owned homes for sale!

CLICK HERE for official announcement from HFA Board Chair, Chester A. Bishop!

Two fully renovated homes are available for sale, along with up to $120,000 (Combined funds) in purchase assistance to qualified, eligible homebuyers.

Submissions will be accepted until April 11th at 3:00 PM. Learn more about the sale of these properties and link to apply http://hollywoodfl.org/1435/City-owned-Homes-For-Sale.

Do not miss this excellent opportunity with ALL interested and eligible First Time Homebuyers!

03/09/2023

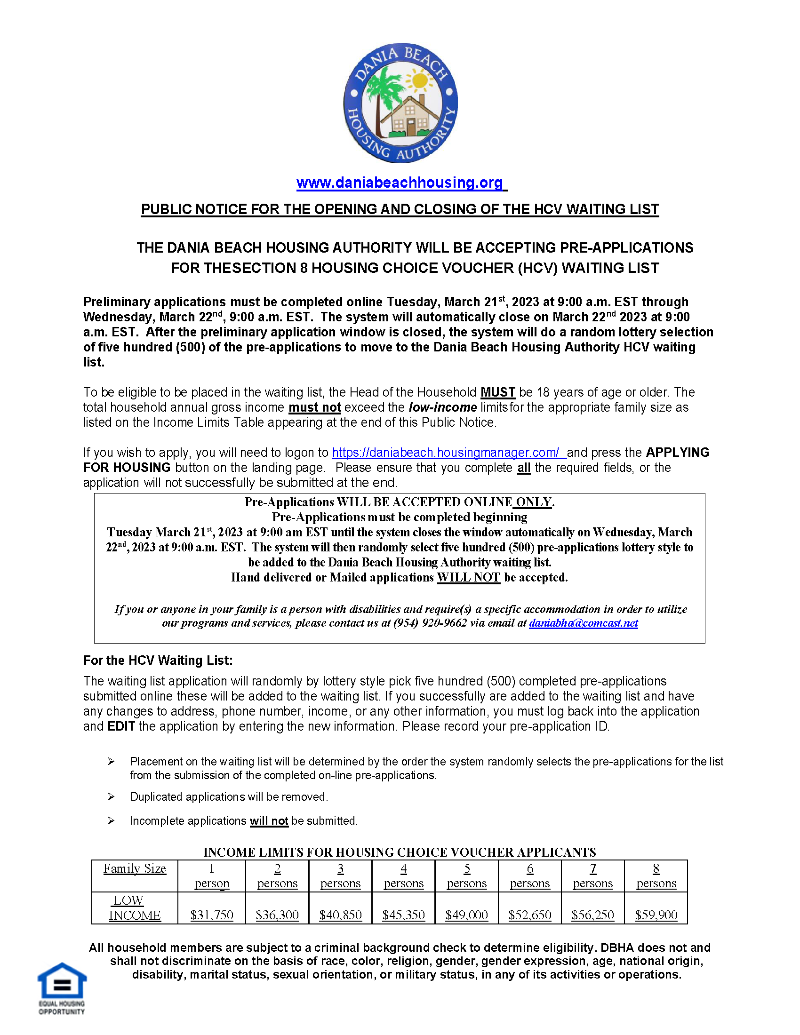

The Dania Beach Housing Authority will be opening the Housing Choice Voucher Lists in March 2023!

Housing Choice Vouchers may be used in all of Broward County with the exception of Hollywood, Florida.

The pre-application list will open Tuesday, March 21st 2023 at 9:00 a.m. EST and will close 24 hours later, March 22nd, 2023 at 9:00 a.m EST. All pre-applications MUST be submitted on line through the web portal at

https://daniabeach.housingmanager.com/

For additional information, please visit https://www.daniabeachhousing.org/

02/10/2023

01/19/2023

_thumb.png)

%20(1)_thumb.png)

12/01/2022

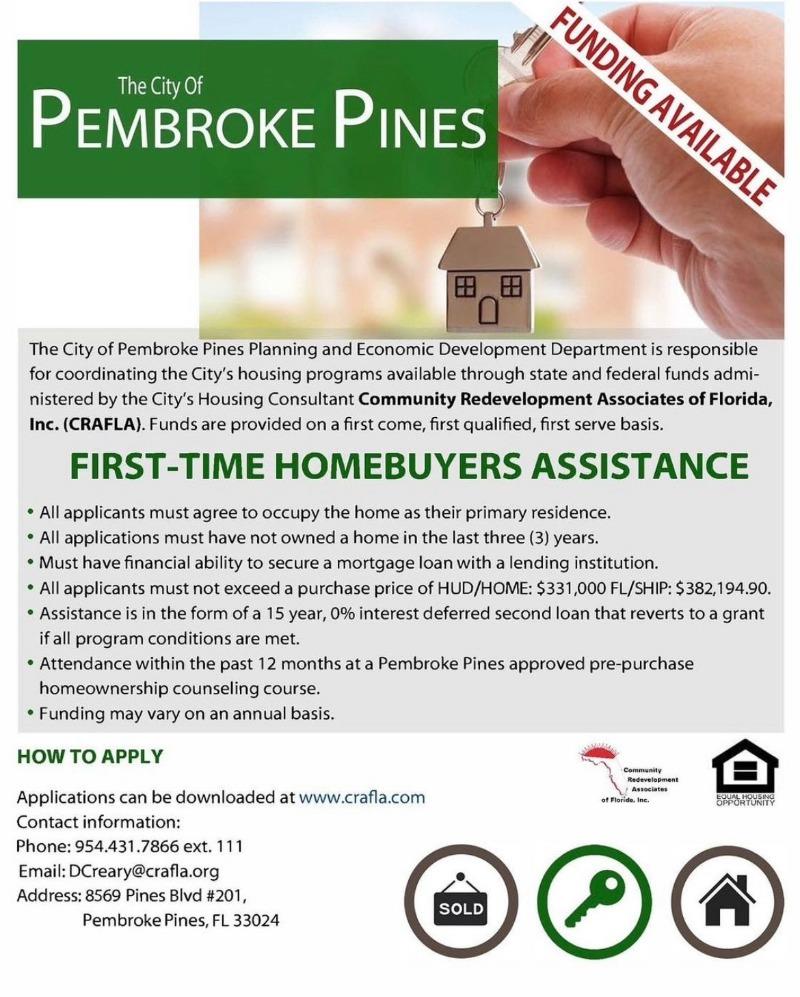

The City of Pembroke Pines has funding available! Act now!

Need to meet the requirements with a Certificate of Completion for Homebuyer Education? CLICK HERE to register for one of HFA's upcoming HUD Certified Home Buyer Workshops

11/16/2022

10/13/2022

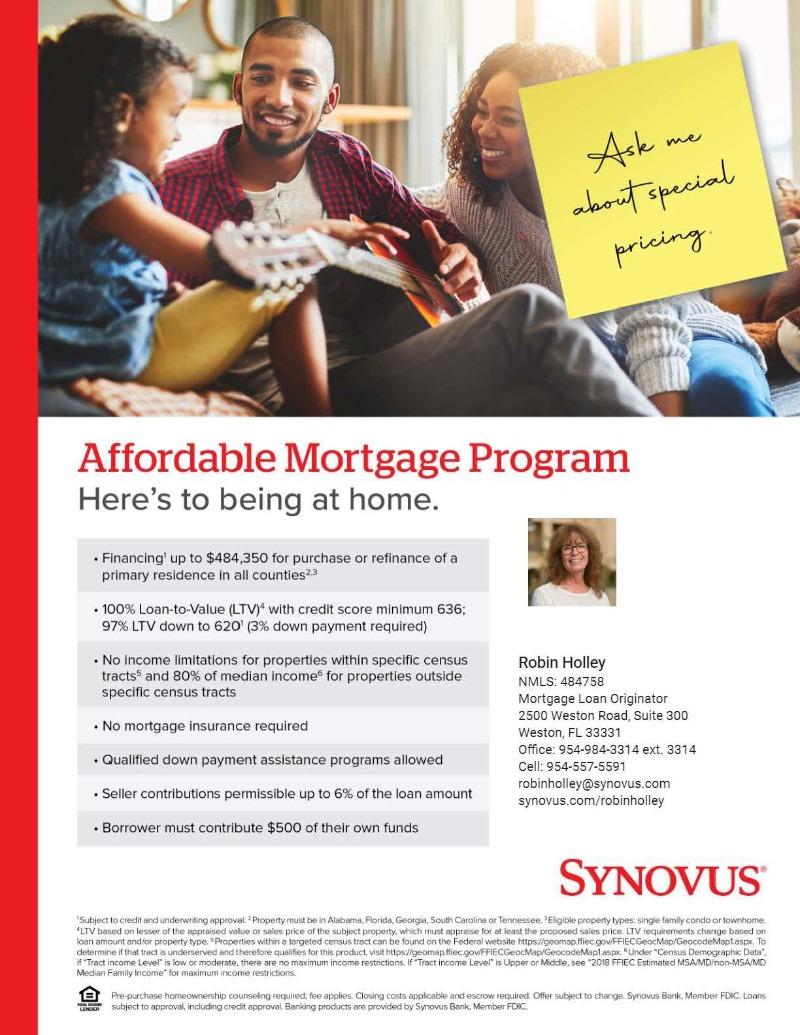

HFA's lender partner, Synovus Bank, can now lend in North Carolina! That will also include their AMP program: up 100% financing with no PMI.

See flyer below. Contact HFA at 954-923-5001 and visit www.HomeApproved.org/Lenders for more about Synovus Bank.

10/07/2022

The City of Hallandale increased their Down payment Assistance funding to $100,000 for the purchase of a first home in the CRA district! These funds are available to affordable housing buyers (whose income is between 50% and 120% of the Broward County median income guidelines) to be used for gap funding and closing costs. The program also provides an incentive of up to $10,000 in down payment assistance for workforce housing buyers whose income is above 120% but not more than 140% median. An additional $5,000 incentive is available for first responders, teachers and nurses. Do not miss this opportunity! CLICK HERE TO APPLY

09/29/2022

09/13/2022

Are you a Home Buyer looking for a home in Forsyth County, North Carolina? Act now and apply for the Forsyth County Community & Economic Development Down Payment Assistance programs: You may earn up to $50,000 in funds towards Down Payment and Closing Costs! CLICK HERE for additional information

09/1/2022

Bank of America Introduces Community Affordable Loan Solution™ to Expand Homeownership Opportunities in Black/African American and Hispanic-Latino Communities. This new program is in addition to and complements Bank of America’s existing $15 billion Community Homeownership Commitment™ to offer affordable mortgages, industry leading grants and educational opportunities to help 60,000 individuals and families purchase affordable homes by 2025: CLICK HERE for more information.

06/30/2022

Act now! Homeowners Assistance Funding is Available now for The City of Hollywood! Click the link or image below for more information:

http://www.hollywoodfl.org/CivicAlerts.aspx?AID=1099

06/02/2022

The Florida Hometown Heroes Housing Program makes homeownership affordable for eligible frontline community workers such as law enforcement officers, firefighters, educators, healthcare professionals, childcare employees, and active military or veterans.

For additional information call HFA at 954-923-5001, also see resources below:

https://fb.watch/doIAlcKlyN/

https://www.floridahousing.org/programs/homebuyer-overview-page/hometown-heroes

This program provides down payment and closing cost assistance to first-time, income-qualified homebuyers so they can purchase a primary residence in the community in which they work and serve. The Florida Hometown Heroes Loan Program also offers a lower first mortgage rate and additional special benefits to those who have served and continue to serve their country.

Program Details:

- Eligible frontline workers can receive lower than market rates on an FHA, VA, RD, Fannie Mae or Freddie Mac first mortgage, reduced upfront fees, no origination points or discount points and down payment and closing cost assistance.

- Borrowers can receive up to 5% of the first mortgage loan amount (maximum of $25,000) in down payment and closing cost assistance.

- Down payment and closing cost assistance is available in the form of a 0%, non-amortizing, 30-year deferred second mortgage. This second mortgage becomes due and payable, in full, upon sale of the property, refinancing of the first mortgage, transfer of deed or if the homeowner no longer occupies the property as his/her primary residence. The Florida Hometown Heroes loan is not forgivable.

04/28/2022

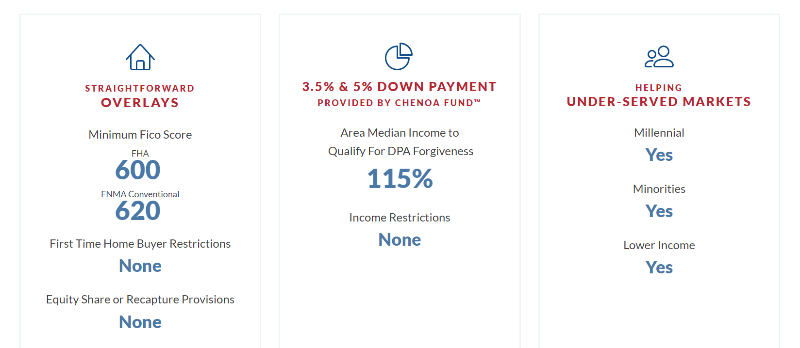

Chenoa Fund is a national down payment assistance program provided through CBC Mortgage Agency. CBC Mortgage Agency's mission is to increase nationwide affordable and sustainable homeownership, with a focus on creditworthy, low and moderate-income individuals.

Click anywhere on the flyer below for additional information:

04/14/2022

Down Payment Assistance Programs: Florida Housing

Disclaimer: Only through participating lenders

Florida Housing offers down payment and closing cost assistance in the form of a second mortgage loan to assist eligible homebuyers with their down payment and closing costs. Down payment assistance is only available when used with Florida Housing's first mortgage loan. Down payment assistance is NOT available as "stand alone" down payment assistance. Florida Housing offers the following Down Payment Assistance Programs to eligible buyers:

The Florida Assist (FL Assist)

- Offers up to $10,000 on FHA, VA, USDA and Conventional Loans.

- 0%, non-amortizing, deferred second mortgage.

The FL Assist is not forgivable. Repayment is deferred, except in the event of the sale, transfer, satisfaction of the first mortgage, refinancing of the property or until such a time the mortgagor ceases to occupy the property at which time, the Florida Assist will become due and payable, in full.

The Florida Homeownership Loan Program (FL HLP) Second Mortgage

- Offers $10,000.

- 3% fully-amortizing, second mortgage.

- 15-year term.

The FL HLP Second Mortgage carries a monthly payment. The remaining unpaid principal balance (UPB) is deferred, except in the event of the sale, transfer of deed, satisfaction of the first mortgage, refinancing of the property or until such a time the mortgagor(s) ceases to occupy the property as his/her primary residence at which time, the FL HLP Second Mortgage will become due and payable, in full.

Since the FL HLP Second Mortgage carries a monthly payment, this payment may need to be considered in a borrower’s debt-to-income (DTI) ratio when credit underwriting.

3%, 4% and 5% HFA Preferred and HFA Advantage PLUS Second Mortgage

Borrowers utilizing these down payment and closing cost programs receive 3%, 4% or 5% of the total loan amount in a forgivable second mortgage. This second mortgage is forgiven at 20% a year over its 5-year term when used with Florida Housing’s conventional HFA Preferred for TBA or HFA Advantage for TBA first mortgage products. The “PLUS” Second Mortgage is available only with these conventional first mortgage products.

04/07/2022

_thumb.png)

03/24/2022

Are you looking for assistance in buying your first home? The City of Miami's First Time Homebuyer program provides zero percent (0%) deferred loans to first-time homebuyers purchasing a property in the City of Miami if they qualify based on their income category.

Click the link below for more information:

https://www.miamigov.com/Housing-Assistance-Recovery/Home-Ownership/Apply-for-First-Time-Homebuyer-Assistance

03/03/2022

Click the link below to see new information regarding Statewide Homeowner Mortgage Assistance. The Florida Department of Economic Opportunity (DEO) is running the program.

https://www.floridajobs.org/community-planning-and-development/homeowner-assistance/homeowner-assistance-fund

02/17/2022

Click the link below to view the full article by the Sun Sentinel:

https://www.sun-sentinel.com/business/fl-bz-florida-mortgage-assistance-20220217-6756hcrzd5eengvbc3jzywkvgu-story.html

Florida will distribute $676 million in homeowner mortgage assistance

"the U.S. Treasury Department on Feb. 9 approved Florida’s plan to distribute $676 million in federal homeowner assistance funding included in the $1.9 trillion American Rescue Plan enacted in March 2021."

Here are some eligibility facts

To be eligible to receive funds, homeowners must:

Own a one- to four-unit residence that is their primary residence.

Have experienced a financial hardship after Jan. 21, 2020 (including a hardship that began before then but continued after that date).

Have incomes less than or equal to 150% of the area median income or 100% of the U.S. median income, whichever is greater.

Funding will be prioritized to ensure assistance is delivered first to the most vulnerable homeowners (targeting incomes of 100% or less of area median income.)

What expenses can be covered:

Mortgage payment assistance.

Financial assistance to reinstate a mortgage or pay other housing-related costs.

Assistance for homeowner utilities, internet service, property insurance, etc.

Delinquent property taxes.

Counseling and case management services through a HUD-certified counseling agency.

02/17/2022

Delray Beach: New Affordable Housing Development Coming Soon!

Development of Island Cove – An Affordable Housing Community Located between SW 8th Street and SW 10th Street (north and south respectively) & SW 12th Ave and SW 13th Ave (east and west respectively)

Represented by the Delray Beach Housing Authority and Island Cove, LLC. These two entities partnered to bring a high, quality affordable housing development project to your neighborhood called “Island Cove”.

For more information go to: http://dbha.org/development-update/

09/30/2021

Community Partners Loan Pool

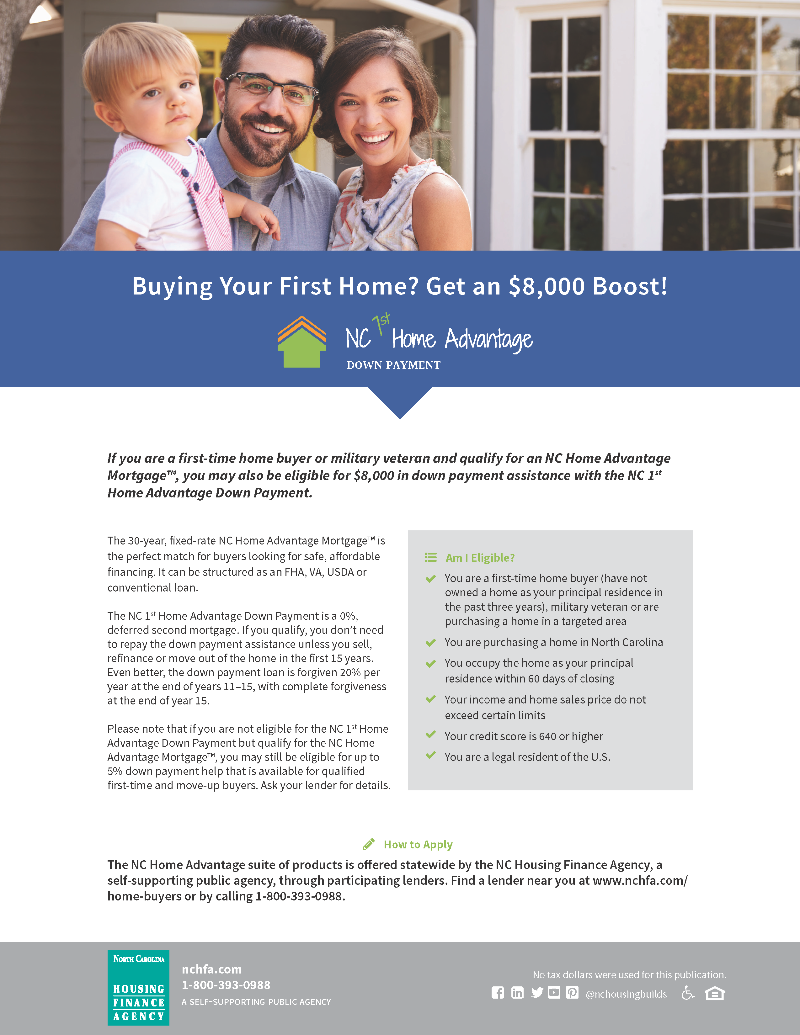

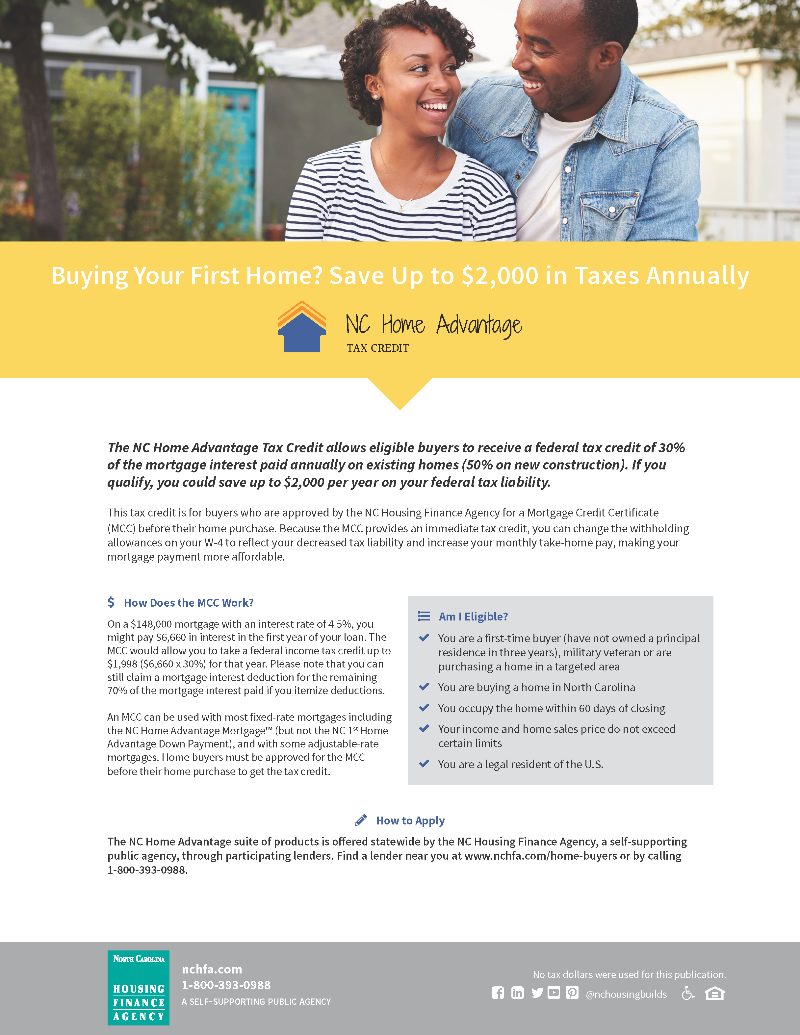

The North Carolina Housing Finance Agency provides financing to local governments and nonprofit organizations to build and rehabilitate homes for low-wealth North Carolinians. The Community Partners Loan Pool (CPLP) provides qualified home buyers with down payment assistance:

Up to 20% of the sales price, not to exceed $30,000 (effective May 1, 2018), when using a NC Home Advantage Mortgage™.

Up to 10% of the purchase price when using a USDA’s Section 502 loan.

CPLP assistance is structured as a 0% interest, deferred second mortgage. The term of the CPLP loan matches the term of the first mortgage. The CPLP Loan has no monthly payment and is typically repaid when the home is sold or at the end of the loan term.

Borrowers may combine a CPLP loan with the NC 1st Home Advantage Down Payment or the NC Home Advantage Tax Credit as well as with other down payment assistance loans or grants.

The program is available through local community partners.

05/04/2021

Helpful Links

Bank of America’s Community Homeownership Commitment®

Bank of America Down Payment Center

Low Down Payment Loans

Bank of America Real Estate Center®

Bank of America First-Time Homebuyer Online Edu-Series™

Better Money Habits®

10/2/2020

Helpful Information

Our Resources can help you understand the home buying process and your rights, provide you with information about the available down payment grants, help you locate resources in Miami-Dade, Broward, and Palm Beach counties, and much more.

Also check out our glossary to understand unfamiliar terms.

Select a County above to get started. Knowledge is Power!