Foreclosure Prevention

Get Help Now!

Resources:

http://www.floridajobs.org/community-planning-and-development/homeowner-assistance/homeowner-assistance-fund

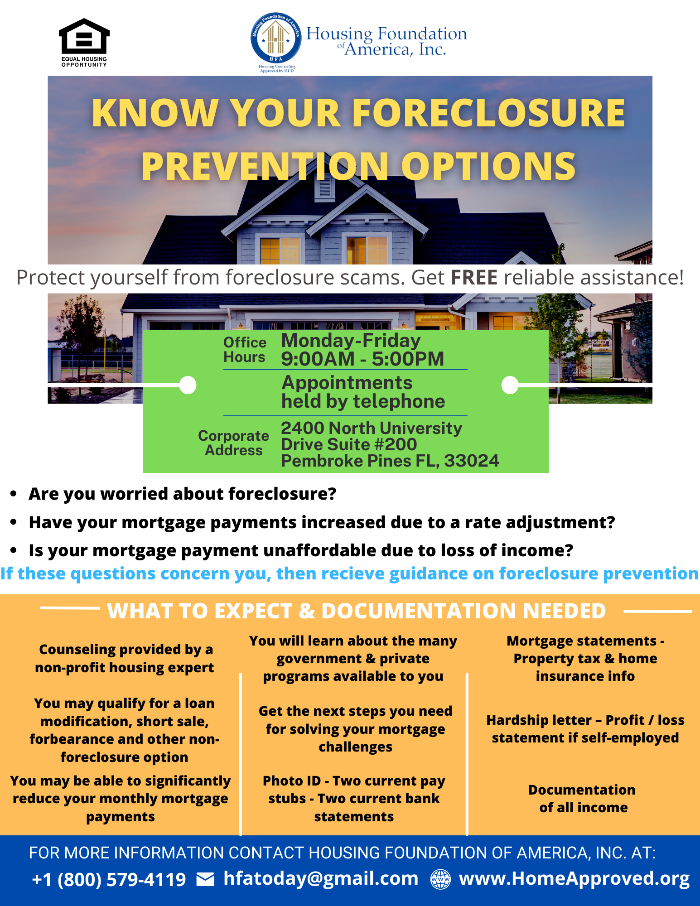

Protect yourself from foreclosure scams. Contact us now and get FREE reliable assistance!

Foreclosure Crisis(Prevention & Avoiding Loan Modification Scams)

Are you worried about foreclosure?Have your mortgage payments increased due to a rate adjustment?Is your mortgage payment unaffordable due to loss of income?

If these questions concern you, check out the tips below about foreclosure prevention...

Foreclosure Prevention Process

Analyze Your Situation & Start getting help immediately!

Learn About Making Home Affordable

The Obama Administration’s Making Home Affordable Program includes opportunities to modify or refinance your mortgage to make your monthly payments more affordable. It also includes the Home Affordable Foreclosure Alternatives Program for homeowners who are interested in a short sale or deed-in-lieu of foreclosure. Find out if you are eligible by clicking the logo above.

Broward County Residents: https://www.browardlegalaid.org/covid-19

HOPE NOW has good homeowner resources

HOPE NOW is an alliance between counselors, mortgage companies, investors, and other mortgage market participants. This alliance will maximize outreach efforts to homeowners in distress to help them stay in their homes and will create a unified, coordinated plan to reach and help as many homeowners as possible. Click the logo above to learn more...

Beware of Loan Modification Scams - Scam artists across the country are preying on homeowners who are facing foreclosure or seeking a loan modification. Anyone can be a victim – but you don’t have to be.

The red flags include people or companies that:

- Ask for fees in advance

- Guarantee they can stop a foreclosure or get your loan modified

- Tell you to stop paying your mortgage company and pay them instead

For loan modification guidance from a HUD-approved counseling agency or to report a scam,call 1-888-995-HOPE or visit www.loanscamalert.org by clicking the logo to the right.

Access Your Options

If the Making Home Affordable Program is not an option for you there may be other alternatives. By working with your lender you can determine if you are eligible for any of the following workout options:

Refinance: If you have enough equity in your home, your new mortgage could pay off the old loan along with any late fees and attorney fees. If you decide to pursue a refinance, remember to shop around for the best terms and compare the Annual Percentage

Reinstatement: Your lender may agree to let you pay the total amount you are behind, in a lump sum payment and by a specific date. This is often combined with forbearance when you can show that funds from a bonus, tax refund, or other source will become available at a specific time in the future. Be aware that there may be late fees and other costs associated with a reinstatement plan.

Forbearance: Your lender may offer a temporary reduction or suspension of your mortgage payments while you get back on your feet. Forbearance is often combined with a reinstatement or a repayment plan to pay off the missed or reduced mortgage payments.

Repayment Plan: This is an agreement that gives you a fixed amount of time to repay the amount you are behind by combining a portion of what is past due with your regular monthly payment. At the end of the repayment period you have gradually paid back the amount of your mortgage that was delinquent.

Loan modification: This is a written agreement between you and your mortgage company that permanently changes one or more of the original terms of your note to make the payments more affordable.

Depending on your circumstances it may not be possible to keep your home. But there are still options available to you including to prevent foreclosure:

Short Sale or Short Payoff: In cases where you sell your home for less than you owe, your lender may accept the lesser amount.

Deed-in-lieu of foreclosure: Your lender may accept the voluntary transfer of the title of your home back to them in exchange for cancellation of your mortgage debt. This approach may have tax implications for you, and it may not be possible if there are other liens against your home.

Assumption: This option permits a qualified buyer to take over your mortgage debt and the mortgage payments, even if the mortgage was originally non-assumable.Be aware that some workout options affect your credit rating more than others. Foreclosures, short sales and deeds-in-lieu of foreclosure are considered "not paid as agreed" and may have serious negative impact on your credit score.

That is why it is important for you to get help early to try to prevent further damage to your credit. For more information about your credit and how alternatives to foreclosure may affect it, visit www.myfico.com

Prioritize Your Debts and Avoiding Delinquencies

Prepare information For Your Lender and Contact your Lender Directly

When you call your lender, be sure to have your account information handy and be ready to give a summary of the financial problems you are having. You should also have recent income statements and your household budget with you.

If you don't have a budget, now is the time to know exactly what you are spending each month. If you can, have your budget information on hand before calling your lender.

Be prepared for more than one conversation. Your lender may require you to complete a loan workout package. It is important that you complete it as soon as you receive it because in some cases the lender cannot proceed to the next step without the completed and signed documents.

Questions to ask:

- How much time is the lender willing to give you to complete a work-out?

- What are your obligations under the work-out package?

- What are the specifics? Be sure to ask what is due and when.

- Will a foreclosure sale of your property be put on hold while your lender looks at the possibility of a workout package?

HOUSING FOUNDATION OF AMERICA, INC.

PRIVACY DISCLOSURE

Housing Foundation of America, Inc. has implemented policies and procedures to protect the security and confidentiality of your nonpublic personal infonnation. Housing Foundation of America, Inc. would like to take this opportunity to inform you how we gather, use and maintain this information. This privacy policy complies with federal laws and regulations.

Privacy Policy

We collect nonpublic personal information about you from the following sources: 1. Information we receive from you; 2. Infonnation about your transactions with us or others; and 3. Information we receive from your creditors or a consumer reporting agency.

We may disclose the following kinds of nonpublic personal information about you: 1. Information we receive from you, such as your name, address, social security number, assets and income; 2. Information about your transactions with us or others, such as your account balance, payment history, parties to transactions, and credit card usage; and 3. Information we receive from a consumer reporting agency, such as your creditworthiness and credit history.

We may disclose nonpublic personal information about you to third parties such as government agencies, your creditors, financial service providers and lenders. It is ve1y important that Housing Foundation of America, Inc. be allowed to openly communicate with such third parties in order to serve your interests. Therefore, if you prefer that we not disclose nonpublic personal information about you to third parties, you should not participate in our program.

We maintain physical, electronic and procedural safeguards to protect nonpublic personal information about you from unauthorized access or intrusion. We limit access to the nonpublic personal information about you only to those employees, contractors and agents who need such access in connection with providing products or services to you or for other legitimate business purposes.

We will at all times comply with all laws and regulations to which we are subject regarding the collection, use and disclosure of individually identifiable information.