Homebuyer Essentials

So you’re thinking about buying a home... We can help!

Contact one of our experienced housing counselors to get started!

Also you can find general information below about the homebuying process and the important steps to make it happen the right way!

Buying a Home

Is buying a home right for me?

Can I afford to buy a House?

Your income, savings, and monthly expenses play an important role in determining how large a mortgage you can afford. To figure out the amount you can afford, please click Affordability.

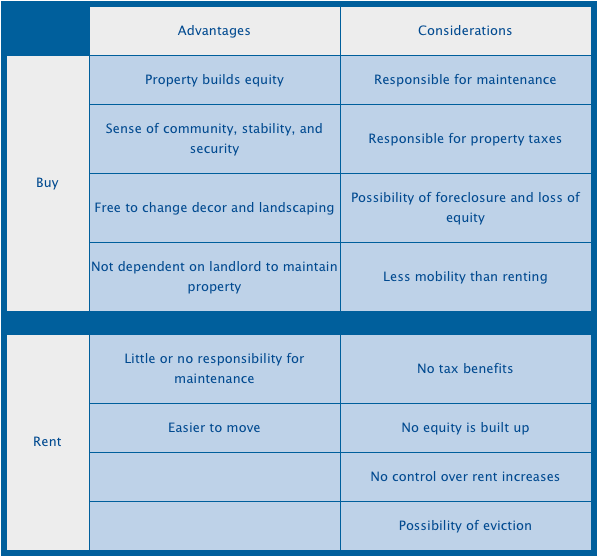

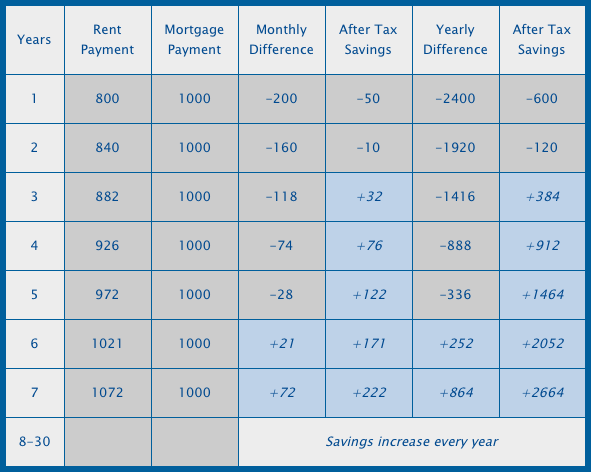

View the advantages of buying a home versus renting one in the Buy vs. Rent Comparison Chart, or view a financial comparison of buying versus renting in the Buy vs. Rent Calculator.

Advantages & Disadvantages of Buying a Home Chart

Buy vs. Rent Comparision Chart

In the chart below, a renter starts paying $800 per month for rent with an annual increase of 5%. The homeowner purchases a home for $110,000 and pays a monthly mortgage of $1000. After 6 years, the homeowner's payment is lower than the renter's monthly payment. With the tax savings of homeownership, the homeowner's payment is less than the rental payment after 3 years.

Monthly Costs of Buying a Home

Your rental company takes part of your rent payment to cover certain housing expenses. When you decide to purchase a home, you accept responsibility for paying for these expenses (listed below).They are additional costs to your monthly mortgage payment and should be included in your budget estimates:

- Property Taxes and Special Assessments

- Home/Hazard Insurance

- Utilities

- Maintenance

- Home Owner Association (HOA) Fee (Doesn't apply to all purchases. It pays for trash and snow removal and maintenance of common grounds, if applicable)

- Membership Fee (It may pay for recreational facilities and other services, such as cable TV)

Mistakes to Avoid When Buying a Home

Most people these days use financing to afford their home, and a very common mistake that is made by many home buyers is making a major purchase, such as a car, not long before trying to buy their new home. This may not sound like a problem initially, but lenders use something called the debt to income ratio to help determine whether or not you can actually afford a home that is in a certain price range. Unfortunately, by increasing your consumer debt for purchases like a car or some other installment payment, you only decrease the amount of house that you can buy through most lending institutions. So avoid this mistake and eliminate all major purchases as much as possible before purchasing a home.

Another common mistake is changing jobs just before buying a home. Again, lenders don't like to see this. They prefer instead to see consistency at the job, so do your best to stick it out at your job, at least until your home is bought and the papers are signed.If you happen to be buying your home as a for sale by owner deal, a big mistake that you want to avoid is to be careful not to give any down payment money to the homeowner themselves before the transaction is actually completed. Unfortunately, some unscrupulous homeowners have taken the down payment money that they have received and spent it before the deal was closed. If for any reason the deal falls through, you can imagine how difficult it would be trying to get your money back in such a situation. The wise course of action is to put the down payment in a trust fund overseen by an attorney, so that access to the money cannot be gained by either party until either the house closes or the deal falls through.

Believe it or not, some home buyers actually forget to arrange to have their utilities activated in their new home before they move in. This can lead to some very uncomfortable days spent in your new home that are unnecessary. So make a note to yourself to both arrange for turning off utilities at your old residence, and getting them turned on in time at your new home.

Having a good real estate agent to look out for your interests as you buy your new home is an important asset that you don't want to overlook either. It's their job to keep up with all the details of the deal from day-to-day, and keep everything moving smoothly on track toward closing. They can help shield you from much of the frustration and day-to-day angst associated with buying a new home.

Some home buyers fail to stay up with the requirements of the lender as the home progresses to closing too, and then find themselves way behind in the process at the very last minute. Sometimes this can lead to delay or even cancellation of the house closing, so take care of your end of the deal by staying on the same page as the lender all the way through the process.The more education that you have about possible costly mistakes that could be made in buying a home, the more chance you have to keep the whole home buying process moving along smoothly and quickly toward a successful close.

How do you draw the line between a money pit and a diamond in the rough?

Here are three things to keep in mind. Depending on the circumstances, these might be reasons not to buy.

Neighborhood

Unlike the rental world, where neighbors last a year, a house is a long-term commitment. Your neighbors when you move in may very well be your neighbors for some time to come, and that's something to keep in mind when looking at a potential new home.

Also consider proximity of the house to things like schools, stores, and major roads. If there's a highway nearby, some questionable properties, an unfriendly feeling, or anything else that feels uncertain, it might be wise to give that house a pass. After all, you might be able to fix your house, but you can't fix your neighborhood.

Major repairs.

Many inexperienced home buyers make the mistake of not checking out every aspect of the property thoroughly. Getting a great deal on a house with a roof that needs replacing is not that great of a deal. Check out the furnace, central air, and the plumbing and electrical systems.Major problems don't necessarily mean you shouldn't buy the property, but they should be included in the price negotiations. A good realtor or seller will factor in such considerations, and you may be able to buy the house for less if it's understood that you're responsible for replacing the roof. Just don't get duped. Don't take anyone's word that the furnace is new- make sure of it.

Water Damage.

Check this one out- thoroughly. Is the house located in a high-flood area? Is something important (like the roof or basement) leaking? If water damage occurred once it's not likely to stop unless the problem -- aka the flow of water -- is corrected. This could lead to expensive irrigation systems and internal repairs.

I heard a horror story of a house that began with a water spot on a wall, and led to removing the floor and vacuuming out two feet of water. Water damage is often a sign of a bigger problem. Unless you can trace it to its source and identify how to stop it, it might be best to steer away from water-damaged property altogether. Why sign up for trouble?

Keeping your eyes open going into a real estate negotiation is the most important thing. If something doesn't feel right, trace it backwards until you figure out why, and then decide if it's worth it to go ahead with the purchase.

Sometimes you'll find it's easy to walk away from a great house in a bad neighborhood. Other times, you can get your purchase price substantially reduced if you can point out exactly what repairs are needed. The trick is to catch those needed fixes -- because the seller may not point them out for you.