Down Payment Assistance Resources:

12/02/2025

Lee County HOME Down Payment Assistance Program (HOME DPA):

| Household Size | Max Household Income |

| 1 | $57,250 |

| 2 | $65,400 |

| 3 | $73,600 |

| 4 | $81,750 |

| 5 | $88,300 |

| 6 | $94,850 |

| 7 | $101,400 |

| 8 | $107,950 |

Click Here for additional program information

11/24/2025

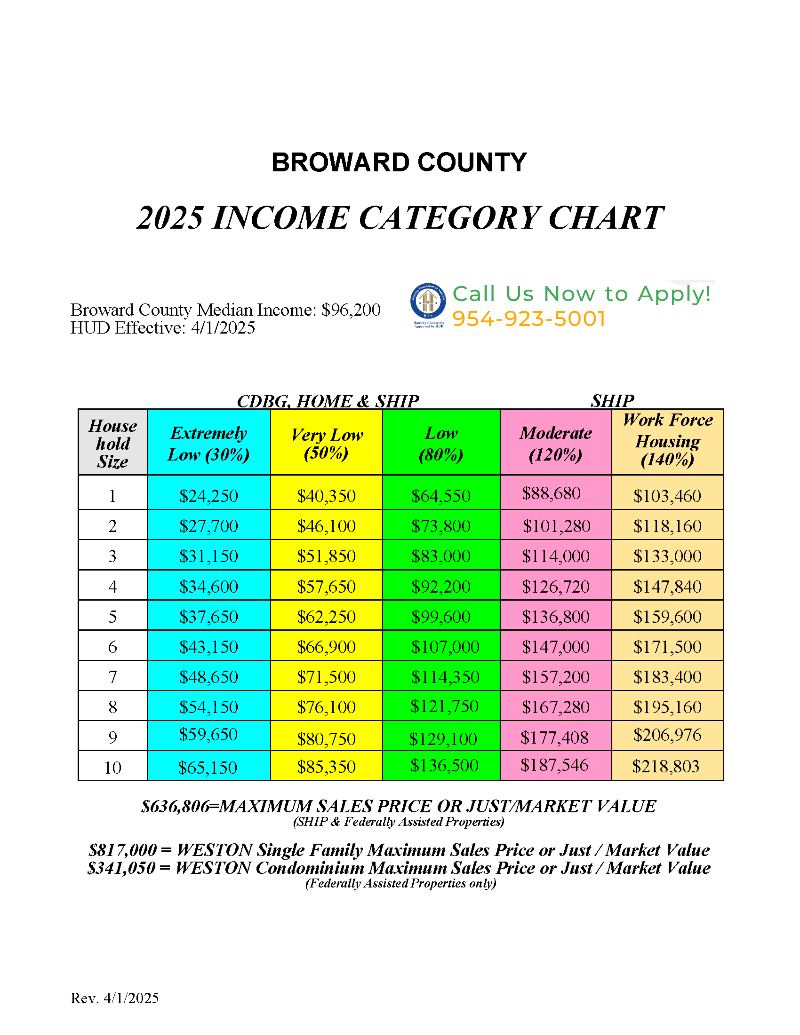

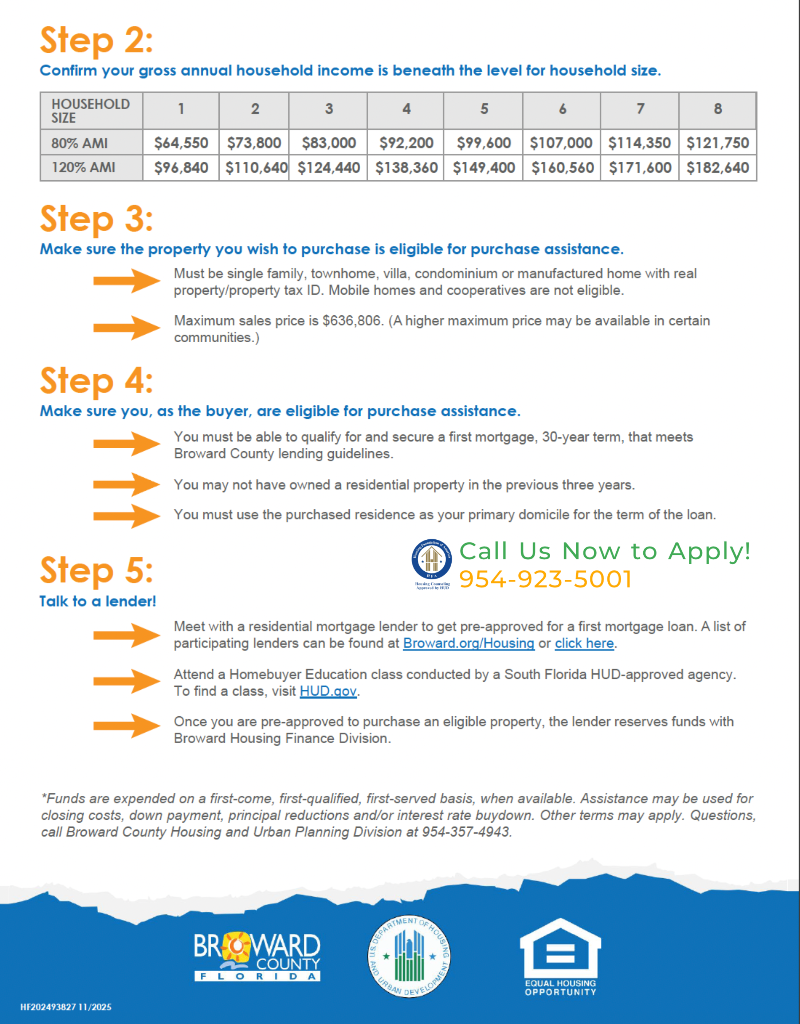

Broward County Homebuyer Purchase Assistance (HPA) program has LIMITED Funding available - Don't wait; Register for an upcoming workshop today!

Click Here to Register for a FREE HUD-Certified Home Buyer Workshop! Learn how you may receive up to $90,000 in Down Payment Assistance and Closing Costs depending on the program

11/17/2025

As of November 17, 2025, all available funds for the City of Tamarac Down Payment Assistance Program have been fully allocated. The City is no longer accepting new applications at this time. Please check back for future updates or announcements regarding additional funding opportunities.

Never miss a down payment assistance update: Get the Housing Foundation Home Search App and stay informed! Search homes. Get updates. Unlock opportunities. Download the Housing Foundation Home Search App now available for FREE on Apple App Store & Google Play Store.

Helpful Links

Bank of America’s Community Homeownership Commitment®

Bank of America Down Payment Center

Low Down Payment Loans

Bank of America Real Estate Center®

Bank of America First-Time Homebuyer Online Edu-Series™

Better Money Habits®

Helpful Information

Our Resources can help you understand the home buying process and your rights, provide you with information about the available down payment grants, help you locate resources in Miami-Dade, Broward, and Palm Beach counties, and much more.

Also check out our glossary to understand unfamiliar terms.

Select a County above to get started. Knowledge is Power!

Pl

Required Documents - At the time of application submittal, the following documents must be provided:

- Copy of Pre-Approval Letter from a First Mortgage Lender (Mandatory)

- Copy of valid Drivers' License or State Identification for ALL adult household members

- Copy of U.S. Birth Certificates or valid U.S. Passport or Naturalization Certificate for ALL household members. For all Non-U.S. Citizen household members provide a copy of a valid Permanent Resident Card

- Copy of current Verification of Employment (VOE) completed and signed by employer within 30 days of submission of application (Preferred) (OR) copy of most recent 30 days paycheck stubs (one month) for ALL working adult household members

- Copy of most recent Social Security, Retirement and/or Disability Award Letter for ALL household members

- If an adult student is employed – copy of student enrollment or current class schedule

- If unemployed, a copy of unemployment benefits statement (OR) a completed Unemployment Affidavit for ALL household members

- Wage Earner Statement from Social Security Administration for ALL unemployed adult household members

- If self-employed provide a completed YTD Profit and Loss (P & L) Statement for ALL adult household members AND most recent three (3) years of tax returns –all pages- (signed and dated) as submitted to the IRS (OR) current 1099 Income earner AND most recent three (3) years of tax returns –all pages-(signed and dated) as submitted to the IRS

- Proof of child support documentation

- Legal documentation for adoption, divorce, battered spouse & restraining order

- Completed Verification of Deposit (VOD) (Preferred) for ALL current accounts (checking and savings) for ALL adult household members (OR) copy of most recent bank statement for all accounts – all pages

- Most Recent Statement Account for: CD, Investment account, Whole life insurance, stocks and bonds) for ALL adult household members

- Most recent tax returns – all pages-(signed and dated) as submitted to the IRS and corresponding W2s/1099s- look for “other income" Schedule “C" (Mark out the first five digits of your social security number before submitting)

- Certificate of Completion for Homebuyer Education from a HUD Certified Counseling Agency or Neighborworks America (OR) Documentation of an upcoming scheduled appointment (Search for a HUD Approved Housing Counselor near you or contact one of our Housing Partners)

- County's Eight (8) Hour Homebuyer Education Counseling Certification form completed by the Counseling Agency's Instructor

NOTE: ALL Applicants are required to have a First Mortgage Loan approval from a lender before applying

Additional Information:

- Funds will be awarded as a 0% interest deferred payment loan secured by a recorded Mortgage, Promissory Note and Declaration of Restriction for 30 years. The loan is forgiven at the end of the 30-year term.

- The property's purchase price cannot exceed $568,557

- Applicant(s) cannot currently own a home

- First Time Homebuyer under the HUD definition: An individual who has no ownership in a principal residence during the 3-year period ending on the date of purchase of the property. This provision is limited to a spouse (if either meets the above test, they are considered first-time homebuyers). A single parent who has only owned with a former spouse while married. An individual who is a displaced homemaker and has only owned with a spouse. An individual who has only owned a principal residence not permanently affixed to a permanent foundation in accordance with applicable regulations. An individual who has only owned a property that was not in compliance with state, local or model building codes and which cannot be brought into compliance for less than the cost of constructing a permanent structure.

- Applicant may not currently own or have liquid assets exceeding $200,000, and/or combination of liquid and non-liquid assets exceeding the current purchase price limit (excluding their primary residence).

PRE-APPLICATION ORIENTATION: Before submitting an application, applicants may attend one of the Virtual Pre-Application Orientations listed below:

- Tuesday, April 15, 2025 at 10:00 am

- Tuesday, April 22, 2025 at 12:30 pm

- Thursday, April 24, 2025 at 2:00 pm

- Tuesday, April 29, 2025 at 4:00 pm

- Thursday, May 1, 2025 at 3:30 pm

The Virtual Pre-Application Orientation Meeting WebEx link is:

Meeting Number: 2318 765 2947

Password: nXfgnuFT663

(OR) Dial (904)-900-2303 or (844) 621-3956 (Toll Free) to join by phone

In accordance with the Americans with Disabilities Act (ADA) and Section 286.26, Florida Statute, persons needing a special accommodation to participate in the business, community and/or housing programs through our online application portal, may notify the Department of Housing and Economic Development (DHED), Mortgage and Housing Investments Division at (561) 233-3600 or via email at HEDVerify@pbc.gov, five (5) business days prior to the opening of the application portal. This document may be requested in an alternate format, to help facilitate your process of applying through the online portal. If you are unable to find assistance to apply through the online portal, we can provide a list of agencies who may be able to help (charges from that agency may apply). Contact DHED for more information and the process.

For additional information, please contact:

Palm Beach County Department of Housing and Economic Development (HED)

Mortgage and Housing Investments Division

100 Australian Avenue, 5th Floor, West Palm Beach, FL 33406

Telephone: (561) 233-3600 Receptionist or Antoinette Prescott (561) 233-3606 or Rommel Sankhi (561) 233-3693

Email: HEDVerify@pbc.gov

Accessibility Statement: https://discover.pbcgov.org/Pages/Accessibility-Statement-Resources.aspx